In the dynamic landscape of small business operations, having the best payroll services can make all the difference. As we look ahead to 2025, the realm of payroll management for small business owners is set to witness significant transformations and innovations.

From the importance of accuracy to the integration of cutting-edge technologies, the future of payroll services is brimming with possibilities. Let's delve into the realm of Best Payroll Services for Small Business Owners in 2025 to uncover key insights and trends that can shape the success of your business.

The content of the second paragraph that provides descriptive and clear information about the topic

Importance of Payroll Services

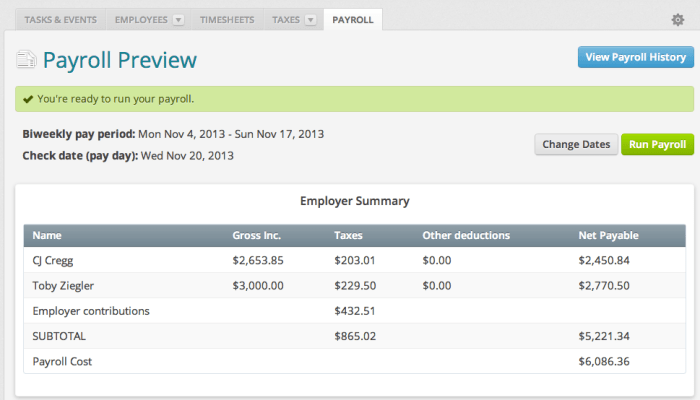

Efficient payroll services play a crucial role in the smooth operation of small businesses. From ensuring timely and accurate payment to employees to maintaining compliance with tax regulations, payroll services are essential for the financial health of a company.

Impact of Accurate Payroll Management

- Prevents costly errors: Accurate payroll management helps avoid costly mistakes such as overpaying or underpaying employees, which can impact the company's bottom line.

- Boosts employee morale: Timely and error-free paychecks lead to satisfied employees, boosting morale and productivity within the organization.

- Enhances financial planning: By maintaining accurate records, businesses can better plan and manage their finances, leading to improved decision-making.

Role in Ensuring Compliance with Tax Regulations

- Calculating payroll taxes: Payroll services are responsible for calculating and withholding the correct amount of taxes from employee paychecks, ensuring compliance with tax laws.

- Filing tax forms: Payroll services also handle the timely filing of various tax forms, such as W-2s and 1099s, reducing the risk of penalties for non-compliance.

- Audits and reviews: By maintaining accurate payroll records, businesses can easily provide documentation in case of audits or reviews by tax authorities, avoiding potential legal issues.

Key Features to Look for in Payroll Services

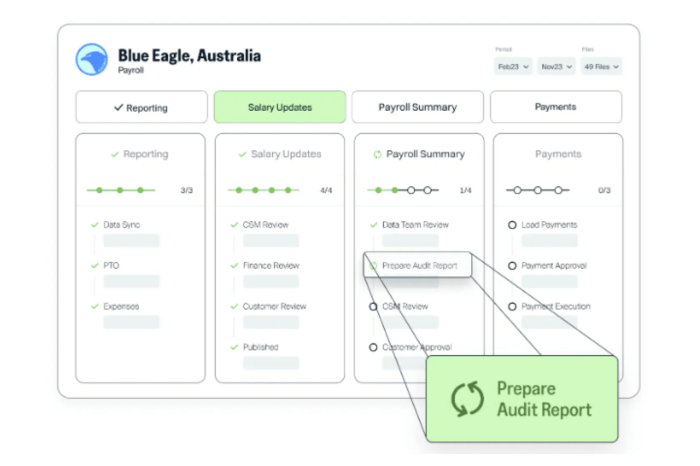

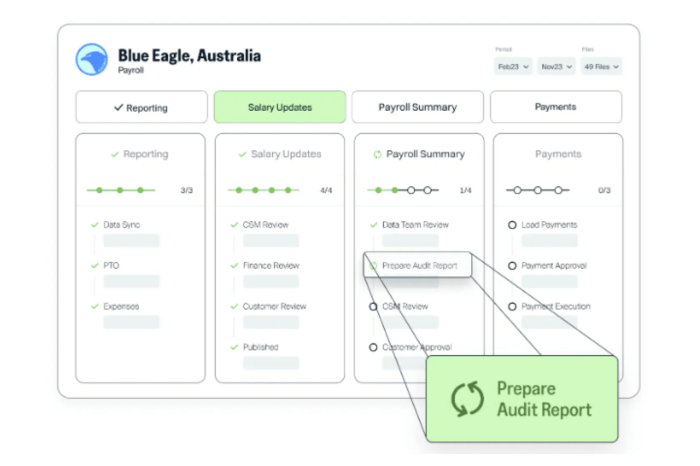

When choosing a payroll service for your small business, it's essential to consider various key features that can make a significant impact on your business operations. From automation to user-friendliness and scalability, these features can streamline your payroll processes and save you time and resources.

Automation

One of the most critical features to look for in payroll services is automation. Automated payroll systems can help reduce errors, ensure compliance with tax regulations, and save time on manual data entry tasks. Look for a payroll service that offers automated calculations, tax filings, and direct deposits to simplify your payroll process.

User-Friendliness

Another important feature to consider is the user-friendliness of the payroll software. A user-friendly interface can make it easier for you and your employees to navigate the system, input data, and generate reports. Look for payroll services that offer intuitive dashboards, customizable settings, and easy-to-use tools to enhance the user experience.

Scalability

Scalability is also a key feature to look for in payroll services, especially for small businesses with plans for growth. Choose a payroll solution that can accommodate your business's changing needs, whether it's adding new employees, expanding to multiple locations, or integrating with other business systems.

Scalable payroll services can help you adapt to growth without having to switch to a new system.

Emerging Trends in Payroll Services for 2025

In the ever-evolving landscape of payroll services, 2025 is poised to witness significant advancements driven by technology. Let's explore the latest trends shaping the future of payroll processing.

Advancements in Payroll Technology

With the rapid digital transformation, payroll technology is advancing at a remarkable pace

. The integration of automation, data analytics, and cloud computing is streamlining payroll processes like never before. Employers can expect more accurate and efficient payroll calculations, reducing the margin for errors and improving overall compliance.

AI and Machine Learning in Payroll Processes

The incorporation of Artificial Intelligence (AI) and Machine Learning algorithms is revolutionizing payroll operations. AI-powered systems can automate repetitive tasks, such as data entry and payroll calculations, leading to increased productivity and cost savings. Machine learning algorithms can also analyze historical data to predict future trends, enabling proactive decision-making in payroll management.

Shift towards Cloud-Based Payroll Solutions

Cloud-based payroll solutions are gaining traction due to their scalability, flexibility, and accessibility. Businesses can now process payroll anytime, anywhere, with real-time data synchronization across multiple devices. The cloud offers enhanced data security, automatic updates, and seamless integration with other HR systems.

Moreover, the shift to cloud-based solutions eliminates the need for on-premise infrastructure, reducing maintenance costs and enhancing overall efficiency.

Cost-Effectiveness of Payroll Services

When it comes to managing payroll for small businesses, cost-effectiveness is a crucial factor to consider. Finding affordable payroll services without compromising quality can help business owners save both time and money.

Tips for Finding Affordable Payroll Services

- Compare pricing plans from different payroll service providers to find the best fit for your budget.

- Look for service providers that offer flexible payment options, such as monthly subscriptions or pay-as-you-go plans.

- Consider bundling payroll services with other HR services to potentially save on overall costs.

- Read reviews and ask for recommendations from other small business owners to ensure you're getting good value for your money.

Cost Savings of Outsourcing Payroll Tasks

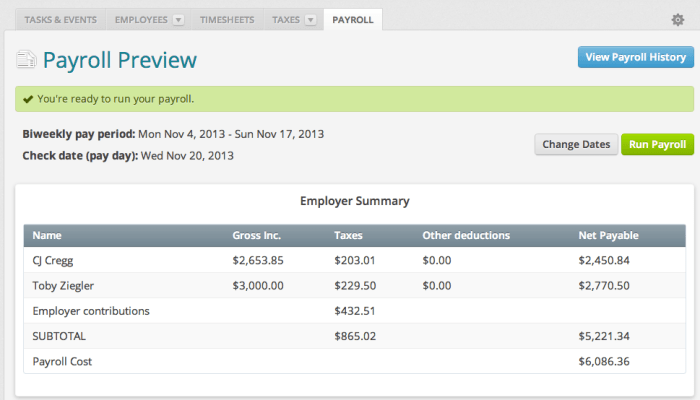

Outsourcing payroll tasks to a third-party service can lead to significant cost savings for small businesses. By outsourcing, businesses can avoid the expenses associated with hiring and training in-house payroll staff. Additionally, outsourcing reduces the risk of costly errors and compliance issues, ultimately saving money in the long run.

Cost Comparison: In-House vs. Outsourcing

| Cost Factors |

In-House Payroll |

Outsourcing to Third-Party Service |

| Employee Salaries and Benefits |

Higher costs for hiring and maintaining payroll staff |

No additional costs for employee benefits or training |

| Software and Technology |

Ongoing costs for payroll software and updates |

Included in service package with no additional charges |

| Compliance and Legal Risks |

Potential fines for non-compliance |

Managed by experts, reducing risk of penalties |

Customization and Integration Capabilities

Customization and integration capabilities are essential aspects to consider when choosing a payroll service provider. Tailoring payroll services to specific business needs and seamlessly integrating them with other accounting or HR systems can greatly benefit small business owners in 2025.

Importance of Customizable Payroll Services

Customizable payroll services allow small business owners to personalize their payroll processes according to their unique requirements. This flexibility ensures that businesses can easily adapt to changes in payroll regulations, employee needs, and company growth. By customizing payroll services, businesses can efficiently manage payroll tasks and ensure compliance with relevant laws and regulations.

Benefits of Integrating Payroll Services

Integrating payroll services with other accounting or HR systems can streamline business processes and improve overall efficiency. By connecting payroll data with other systems, businesses can reduce manual data entry, minimize errors, and enhance data accuracy. Integration also enables real-time access to crucial financial and employee information, providing business owners with valuable insights for decision-making.

Examples of Seamless Integration

Integration with accounting software

Seamless integration between payroll and accounting software allows for automatic synchronization of financial data, simplifying tax calculations, and financial reporting.

Integration with HR systems

Integrating payroll services with HR systems enables the seamless flow of employee data, such as time and attendance records, benefits information, and performance evaluations. This integration eliminates duplicate data entry and ensures data consistency across systems.

Integration with time tracking tools

Connecting payroll services with time tracking tools automates the process of calculating employee hours worked, overtime, and paid time off. This integration reduces manual errors and ensures accurate payroll processing.

Concluding Remarks

As we conclude our exploration of Best Payroll Services for Small Business Owners in 2025, it becomes evident that staying ahead of the curve in payroll management is crucial for business growth and sustainability. By embracing the latest trends, features, and cost-effective strategies, small business owners can streamline their payroll processes and focus on what truly matters - driving their business forward.

The future of payroll services is indeed exciting, promising increased efficiency, accuracy, and seamless integration for small businesses in the years to come.

User Queries

How can small business owners ensure compliance with tax regulations using payroll services?

Small business owners can ensure compliance by choosing payroll services that offer robust tax management features, automated tax calculations, and regular updates to tax regulations. It's essential to work with a service provider that prioritizes accuracy and compliance in payroll processing.

What are the key benefits of integrating payroll services with other accounting or HR systems?

Integrating payroll services with other systems can streamline data management, reduce errors, and improve overall operational efficiency. By syncing payroll data with accounting or HR systems, businesses can achieve better insights, reporting capabilities, and a more cohesive workflow.

How can small business owners leverage AI and machine learning in payroll processes in 2025?

In 2025, small business owners can harness AI and machine learning to automate repetitive payroll tasks, enhance data accuracy, and gain valuable insights from payroll analytics. These technologies can help optimize payroll processes, detect anomalies, and improve decision-making for payroll management.

In the dynamic landscape of small business operations, having the best payroll services can make all the difference. As we look ahead to 2025, the realm of payroll management for small business owners is set to witness significant transformations and innovations.

From the importance of accuracy to the integration of cutting-edge technologies, the future of payroll services is brimming with possibilities. Let's delve into the realm of Best Payroll Services for Small Business Owners in 2025 to uncover key insights and trends that can shape the success of your business.

The content of the second paragraph that provides descriptive and clear information about the topic

In the dynamic landscape of small business operations, having the best payroll services can make all the difference. As we look ahead to 2025, the realm of payroll management for small business owners is set to witness significant transformations and innovations.

From the importance of accuracy to the integration of cutting-edge technologies, the future of payroll services is brimming with possibilities. Let's delve into the realm of Best Payroll Services for Small Business Owners in 2025 to uncover key insights and trends that can shape the success of your business.

The content of the second paragraph that provides descriptive and clear information about the topic

Efficient payroll services play a crucial role in the smooth operation of small businesses. From ensuring timely and accurate payment to employees to maintaining compliance with tax regulations, payroll services are essential for the financial health of a company.

Efficient payroll services play a crucial role in the smooth operation of small businesses. From ensuring timely and accurate payment to employees to maintaining compliance with tax regulations, payroll services are essential for the financial health of a company.

In the ever-evolving landscape of payroll services, 2025 is poised to witness significant advancements driven by technology. Let's explore the latest trends shaping the future of payroll processing.

In the ever-evolving landscape of payroll services, 2025 is poised to witness significant advancements driven by technology. Let's explore the latest trends shaping the future of payroll processing.